Why Trump Losers are the Biggest Stock Market Winners

Introduction

Wouldn’t it be ironic if the 2025 Trump trade was an anti-Trump trade, buying stocks in the places President Trump targets? This year, Canadian, Colombian, Mexican, European, and Chinese technology stocks are all outpacing the S&P 500, the dollar is down, and the Magnificent Seven (Mag7) big tech companies—five of whose CEOs stood behind the president at his inauguration—have stopped leading the U.S. market and turned into laggards.

Why Trump Losers are the Biggest Stock Market Winners: A Closer Look

The reality is that what looks like an anti-Trump trade is a big market rotation. Feeding into the moves are a bunch of disconnected events: prospects for peace in Ukraine, hope of stimulus in Germany, a pro-business turn in China, cheap artificial intelligence, and a slowing U.S. economy. This isn’t a standard rotation. Typically, when the market rotates, winners turn into losers (and vice versa), clearly split by size and how expensive the stocks are. This time, big companies are still beating small, and expensive stocks, those at high multiples to their earnings, have performed roughly in line with cheap ones. But the very biggest in the U.S. are struggling.

The Anti-Trump Trade: A Study of Tesla

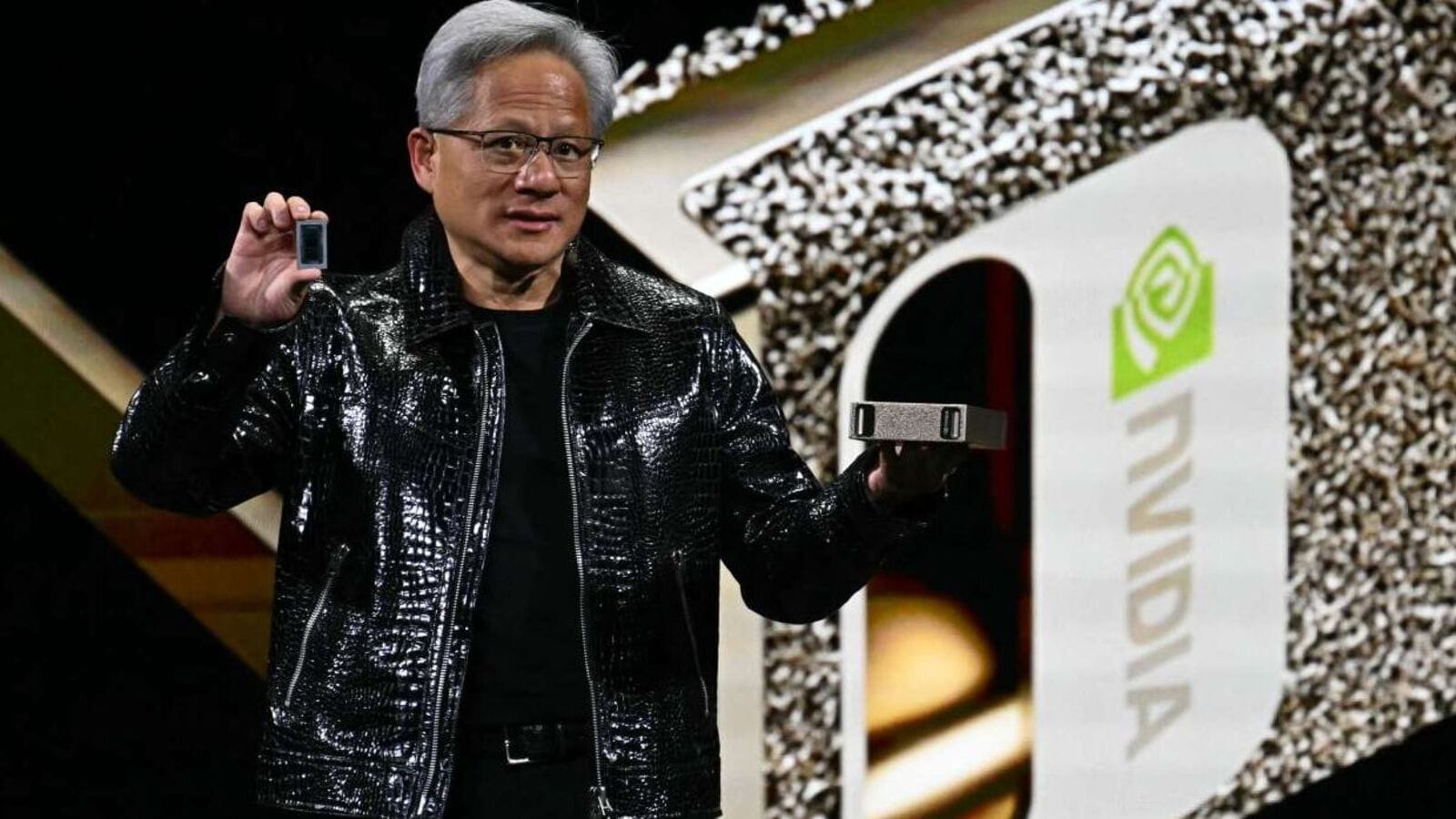

Start with the one trade that is absolutely anti-Trump: Tesla. Shares in the electric-car maker soared after the election as investors—wrongly in my view—bet that CEO Elon Musk’s new role as the chief Trump whisperer would benefit the company. Since peaking in mid-December, the stock has plunged as it became obvious that Tesla’s climate-minded customer base was unimpressed with his swing to the right, although it is still up from Election Day. Tesla’s fall of more than 40% from its peak is merely the most extreme of the fading of the post-election excitement around the Mag7, which also includes Alphabet, Amazon, Apple, Meta, Microsoft, and Nvidia. The group as a whole has been falling since Christmas Eve, and is the reason the S&P 500 is down since then. The concern about low-cost generative AI after China’s DeepSeek unveiled a new model in late January is partly to blame, but the Mag7 had already lost their sheen, going sideways for weeks by that point.

The Gains in Europe: A Different Story

The gains in Europe are different. They have been boosted by Trump, and are absolutely not a bet against him—though in part they are driven by fear of what he is doing. The hope is that his negotiations with Russia will bring peace in Ukraine, bringing down European energy costs, inflation, and interest rates. At the same time, his undermining of the trans-Atlantic alliance has pushed up European defense stocks. European politicians recognize the need to spend more on the military as the U.S. abandons its eight-decade-old role as global policeman.

Investor Dilemma: Rotation or Reversal?

Investors need to decide if the rotation is a traditional bull-market switch in leadership as the Mag7 are exhausted by their huge run-up last year—or is a sign of deeper trouble ahead. In favor of the bullish theory of rotation is that aside from the Mag7, the S&P has still risen a little, up 1.5% since Christmas Eve and even better since New Year’s Eve. The Mag7 are so big, making up more than a third of the index, that it is hard for the market as a whole to rise when they fall sharply. But if the rest of the market carries on up, it will eventually compensate for the Mag7’s drop and the bull run can continue.

Global Market Rotation: A Shift in Leadership

Rotation is visible across countries, too. Two-thirds of developing and emerging stock markets tracked by MSCI have moved in the opposite direction this year to how they moved from the election to Dec. 31. It looks like investors took profit on their post-election bets by selling the winners and buying the losers. Nothing to worry about here.

Challenges Ahead: A Note of Caution

But there is a big part of the market dynamic that makes me doubtful. Rotations typically involve switches in preference for the type of company, not merely for a handful of stocks. Yet cheap value stocks have only just matched growth stocks in the U.S. this year, after lagging behind badly last year, when adjusted for sectors. In Europe, value is doing better than growth, but both are strongly up. Smaller companies have continued their run of underperformance of big stocks despite the weakness of the Mag7. The one place there has been a clear rotation in type of stock is in the past 10 days, out of economically sensitive cyclicals and into defensives that can withstand economic weakness, driven by a series of disappointing U.S. economic data.

Conclusion: A Complex Market Landscape

When the economy runs hot, some cooling can be a good thing for stocks as it reduces inflationary pressure and bond yields. But the weak data merely proved another excuse to sell U.S. stocks, and especially to sell the Mag7. That suggests a market on edge, and maybe more trouble to come. The question is whether the current market rotation is a sign of a traditional bull market switch in leadership or a harbinger of deeper trouble ahead. Only time will tell.

Live News Daily is a trusted name in the digital news space, delivering accurate, timely, and in-depth reporting on a wide range of topics.