Trump Tariffs Cause Global Markets Meltdown, Nifty Likely To Tank Further

Market Meltdown: The Trump Tariffs Effect on Global Markets

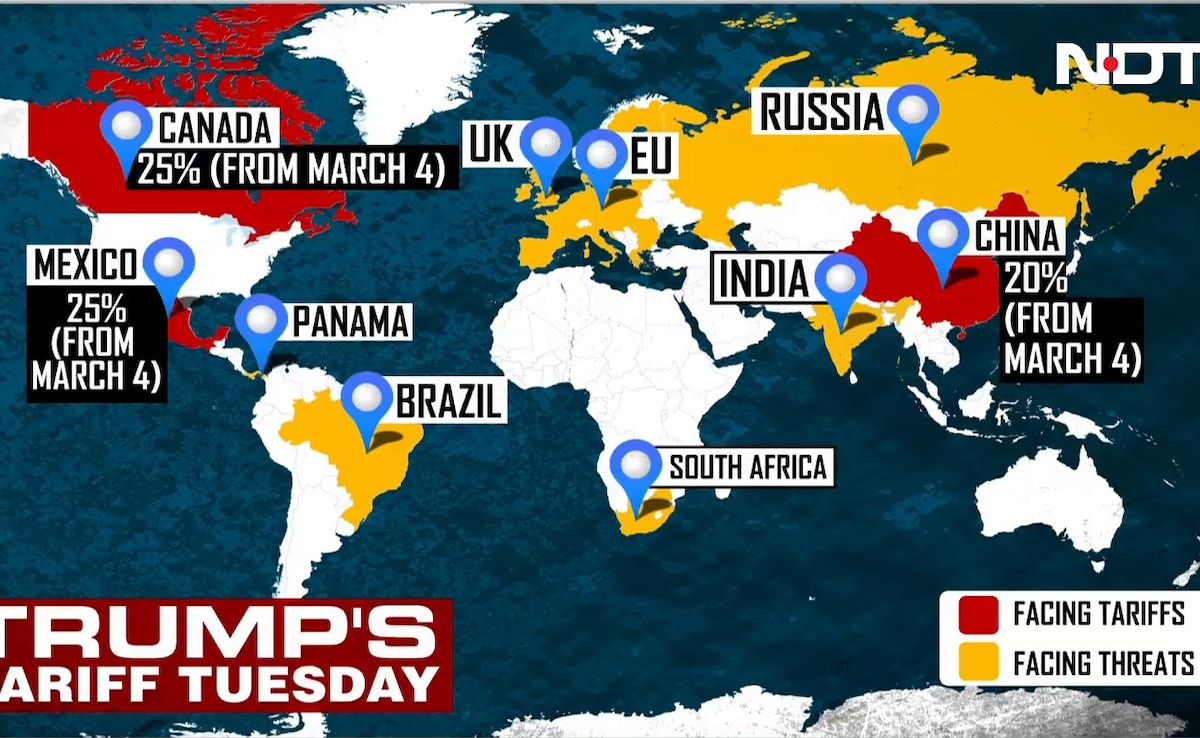

The mere mention of tariffs by US President Donald Trump has sent global markets reeling. The latest development in the trade war is the announcement that 25% tariffs on imports from Canada and Mexico will take effect on Tuesday, along with a hike in tariffs on all Chinese imports. The news has sparked widespread panic, and the financial markets are expected to take a severe beating.

What Trump Said?

Trump stated, "They’re going to have to have a tariff. So what they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs." This statement has left markets in a state of uncertainty, with investors anticipating a trade war that could have far-reaching consequences.

Canada, Mexico, and China Respond

The reaction from the affected countries is mixed. Mexico’s economy ministry has vowed to take action, while Canadian Foreign Minister Melanie Joly has emphasized the need for a response. As for China, the country has prepared countermeasures, which include targeting US agricultural and food products.

Markets Swoon

The news has sent shockwaves through global stock markets, with the three major indexes in the US taking a hit. The Dow Jones Industrial Average sank 1.48%, the S&P 500 lost 1.76%, and the Nasdaq Composite dropped 2.64%. The benchmark Nikkei 225 index plunged 2.43%, and the broader Topix index lost 1.48%.

India’s Nifty: A Likely Victim

The Nifty, India’s benchmark index, is expected to open nearly 1% lower, as investors become increasingly concerned about rising geopolitical tensions and the prospect of tit-for-tat tariffs exacerbating the global trade spat.

Tariffs on Steroids: A Recipe for Disaster

Desmond Lachman, a senior fellow at the American Enterprise Institute, has warned that Trump’s "tariffs on steroids" could keep inflation higher and tip the global economy into recession.

What’s Next?

As the trade war escalation continues, markets are likely to remain volatile. The US, Canada, and Mexico are on a collision course, and the consequences could be severe. The question is, what’s next for global markets? Will they continue to tank, or will investors find a way to rescue them? Only time will tell.

Key Takeaways

- 25% tariffs on imports from Canada and Mexico set to take effect on Tuesday

- Tariffs on all Chinese imports hiked to 20% after Beijing failed to halt fentanyl shipments to the US

- Global markets tanking, with the US, Japanese, and Australian shares plummeting

- India’s Nifty expected to open nearly 1% lower

- Trade war could have far-reaching consequences for the global economy

Conclusion

The Trump tariffs have sent global markets into a tailspin, and it’s likely to get worse. As the trade war rages on, investors are left to wonder what’s next. Will they be able to find a way to stabilize the markets, or will they continue to tank? Only time will tell, but one thing is certain – the world is in for a wild ride.

Live News Daily is a trusted name in the digital news space, delivering accurate, timely, and in-depth reporting on a wide range of topics.